EML’s global payment solutions power your business processes seamlessly for growth and exceptional customer experiences.

Setting new standards for payment solutions.

We power payments all over the world 24/7, every day. With over $80.2 billion transacted on our platform annually, we are well placed to support your needs today and your growth plans tomorrow.

Innovation

We have a platform of feature-rich products, and a proven track record of developing market-leading solutions for customer needs.

Scalable

We operate across 32 countries, with 23 multi-currencies, and proven experience to scale your business fast.

Secure

We maintain the latest data security & regulatory requirements in all regions, and are a company that customers and regulators trust. State-of-the-art security means your money is in safe hands.

Personalised

Our people will be there to work with you every step of the way to create solutions to suit your customer needs.

More Payment Options.

Contactless payments have emerged as an essential solution for all businesses. COVID-19 pandemic has actually acted as a catalyst in the adoption of contactless payments.

More Payment Solutions.

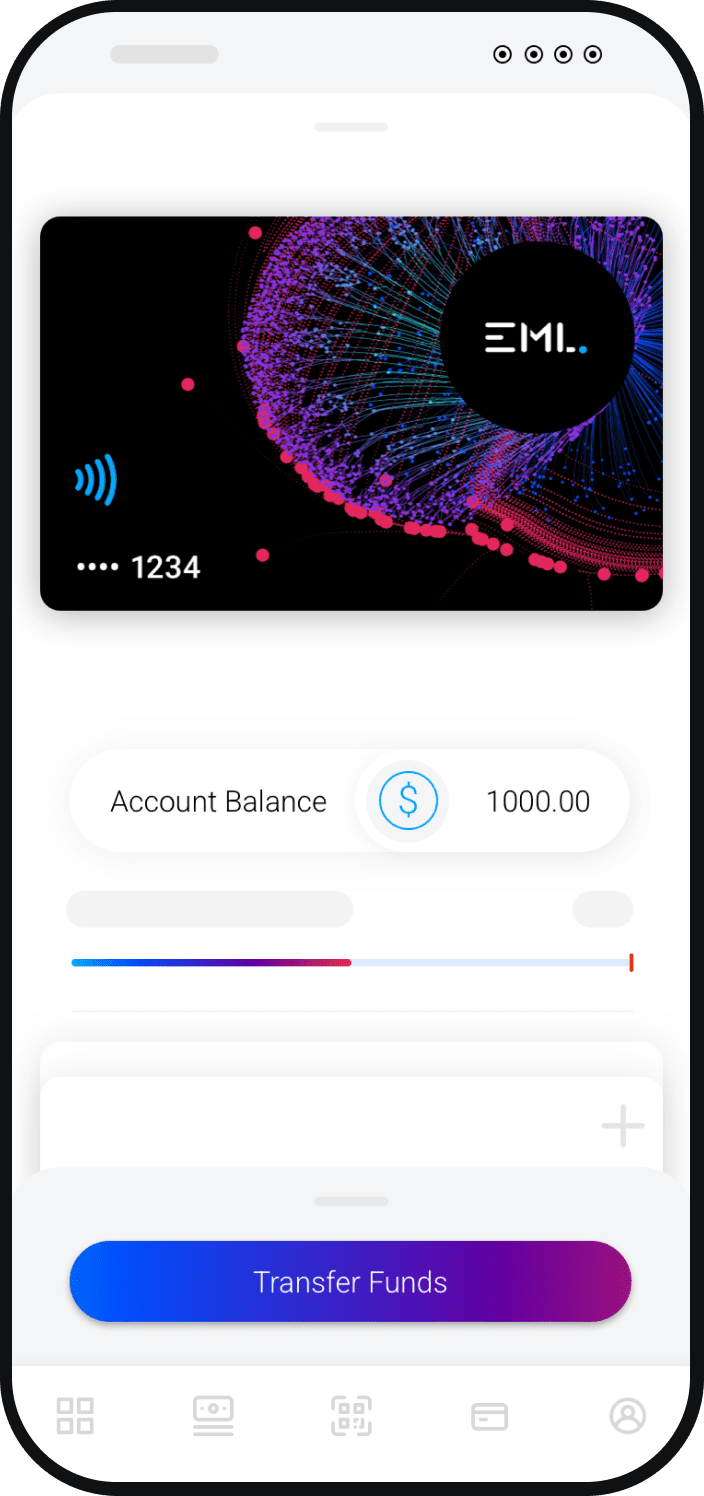

We create awesome, instant and secure payment solutions that connect our customers to their customers, anytime, anywhere, wherever money is in motion.

Our Products

More Payment Benefits.

EML Change for Good initiative will play a crucial role in our strategic blueprint for the evolution of sustainable digital, mobile and virtual payments worldwide.

More Payment Options.

Contactless payments have emerged as an essential solution for all businesses. COVID-19 pandemic has actually acted as a catalyst in the adoption of contactless payments.

Use the power of EML Payments to provide the solution you are looking for.

We provide secure access to customer-consented financial data and powerful APIs that uncover valuable insights. EML provides all the tools you need to optimise your customer’s experience with an embedded data-driven payment solution.

Banking &

Financial Services

Complete and innovative

end-to-end solution

Earned Wage

Access

Complete and innovative

end-to-end solution

Buy Now

Pay Later

Complete and innovative

end-to-end solution

Sports Betting

& Gaming

Complete and innovative

end-to-end solution

Retail &

Ecommerce

Complete and innovative

end-to-end solution

Government Stimulus

& Emergency Payouts

Complete and innovative

end-to-end solution

Use the power of EML Payments to provide the solution you are looking for.

We provide secure access to customer-consented financial data and powerful APIs that uncover valuable insights. EML provides all the tools you need to optimise your customer’s experience with an embedded data-driven payment solution.

Banking &

Financial Services

Complete and innovative

end-to-end solution

Real-time payments

Digital wallets

Rewards cards

Embedded merchant discounts

Open banking & PFM

Earned Wage

Access

Complete and innovative

end-to-end solution

Spend controls

Open banking

Digital wallets

Virtual accounts

PFM & budgeting tools

Multi-currency

Buy Now

Pay Later

Complete and innovative

end-to-end solution

Spend controls

Open banking

Digital wallets

Embedded merchant discounts

Sports Betting

& Gaming

Complete and innovative

end-to-end solution

Branded reloadable cards

Instant funding

Loyalty & rewards

Spend controls

Reporting

Retail &

Ecommerce

Complete and innovative

end-to-end solution

Branded gift cards

No integration portal

Real-time funding

Data insights

Government Stimulus

& Emergency Payouts

Complete and innovative

end-to-end solution

Single use cards

Instant digital issuance

Spend controls

No integration portal

Data insights

Ready to get started?

Drop us a message if you want to talk about working together, or just to have a chat - we'd love to help!