Tokenisation Trends and Benefits

Cash is fast becoming a rare sight these days, as the rapid uptake of contactless and digital payments continues to grow. How people shop and use money has seen massive changes over the last two years, with the global pandemic accelerating the adoption of contactless cards, digital wallets and mobile payments, propelling the growth of the tokenisation market world-wide.

Juniper Research have forecast that global mobile wallet transaction volumes will see a 92% growth in 2023 from 2021 (double the growth of contactless card transactions) and that by the end of this year 99% of all contactless transactions by volume will be tokenised. Their more recent report predicts that over 60% of the global population will be using Digital Wallets by 2026.

❝ The digital cash revolution is definitely one of a few mega trends shaping the future of money and payments. Mobile experience, digital currencies and digital wallets will play an important role going forward, and new payment opportunities are expected to open up in order to deliver the best of both worlds with physical and digital experiences. ❞

– Rachelle St Ledger, CEO of EML Australia

As the world of payments rapidly trends towards digital and on-line payment adoption, we are seeing physical wallets and cash being swapped for digital wallets and tokenised payment cards. Digital wallets and tokenisation will transition from a nice to have to an essential part of business, to meet customer demands for secure, anytime, anywhere payments. If you aren’t sure what it’s all about read on.

-

What are Contactless Payments?

A contactless payment is a wireless transaction using a micro-chip enabled payment card or a mobile device with a digital wallet to make a purchase in-store. A security token is used in close proximity to the Point-of-sale (POS) reader, where each purchase is tokenised and payment information is never shared directly with the vendor Contactless cards use Mastercard PayPass or Visa PayWave technology without needing a PIN or signature. Contactless payments are also often referred to as tap-and-go, touch-free or proximity payments.

-

What is Tokenisation?

Tokenisation can make purchases easier and more secure for businesses and their customers. Tokenisation helps protect sensitive credit card or bank account information by replacing it with unique random letters and numbers called a “token”. Virtual and physical cards must be “tokenised” to be added to a digital wallet (eg. Apple Pay, Google Pay, Samsung Pay etc).

-

What are Digital Wallets?

A digital wallet securely stores payment cards electronically (eg. credit cards, debit cards, gift cards) and can be installed on your mobile device, smartwatch, laptop or desktop computer. Digital wallets allow payments online as well as instore contactlessly. Payment information can be saved by adding a debit card so the user can pay straight from their app by holding their smartphone to a card reader without needing to remember or re-enter their payment credentials. The rapid growth of this technology in recent years has allowed consumers to ditch their physical wallets as we move towards cashless payments.

-

Benefits of Digital Wallets and Tokenisation

There are huge benefits for both organisations and their customers:

- Convenience

These days everyone wants everything fast and hassle-free. Improve user experience by making payments faster, easier and seamless, creating more satisfied customers. Customers can just click and pay, with no need to fill in card details every time they check out online, which is extremely beneficial for subscription billing or recurring payments. This also eliminates the chance of potential repeated mistakes in entering card details and failed payments. - Security

As online payments increase so has the concern for fraudulent activity. Tokenisation can keep everyone’s money safer, allowing more secure in-app mobile transactions. Digital wallets sit within passcode-protected devices, with payments often only possible via fingerprint or face recognition. Many wallets have additional security protocols, like two-factor authentication one-time PINs. - Reduced Risk From Data Breaches

There is real potential for increased fraud in a world full of hackers trying to steal personal data. Tokenization can help protect businesses from the financial impacts of data theft. Even in the event of a breach, customer’s personal data isn’t there to steal as no sensitive data is stored. - Consumer Trust

Trust is particularly important when it comes to money. You can build trust and loyalty with customers by offering secure payment options and keeping payment and other personal data safe from fraudulent threats. - Compliance With Less Red Tape

Businesses that accept credit and debit cards need to be in compliance with the Payment Card Industry Data Security Standard (PCI DSS). Tokenization makes achieving and maintaining compliance with industry regulations significantly easier. Most businesses find that achieving these data security requirements takes time and money, however a payment tokenization provider can help remove this burden and ensure compliance. - Plastic Reduction

We all want a greener and more sustainable future. Digital wallet tokenised payments can help reduce the need for physical plastic cards helping the environment in the process. EML have made a commitment to eliminate 25 million plastic cards by the end of 2023 as part of our “Change For Good” sustainability program.

-

EML Tokenisation Data Trends

EML have been riding the digital growth wave, and as providers of transformative digital and physical card payment solutions, can share some interesting tokenisation trends and insights drawn from our Australian data.

Since 2020 there has been a change in how customers are using their cards to spend, with a steady growth in contactless payments (+24%) and online spending (+48%), simultaneously triggering a decline in physical card spending (-22%).

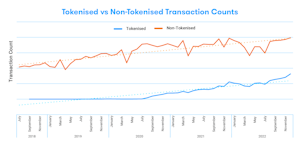

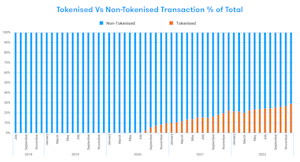

With this digital rise, the number of tokenised transactions have seen a substantial 320% growth in the last 2 years from December 2020.

Accounting for less than 10% in 2020, tokenised transactions now represent almost a third of all transactions, and growing.

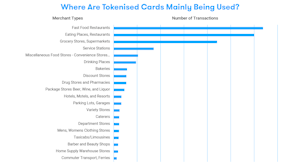

Interestingly, but not surprisingly, tokenised spend data shows that fast food in the form of Uber Eats and Deliveroo was the most significant purchased item during the peak of COVID, with Uber trips rising up the ranks now that there is more social freedom. We have also seen evidence of average tokenised spending increasing at double the rate of non-tokenised spend.

| Top 3 EML Tokenised $ Spend Merchants | ||

|---|---|---|

| 2020 | 2021 | 2022 |

| Uber eats Deliveroo Apple |

Uber Eats EBay Apple |

Uber Eats EBay Uber trip |

In 2022, Fast food and Restaurants remained the overall highest ranked merchant types for tokenised card transactions.

To keep up with the rapid digital payments acceleration, make sure you have secure payment solutions in place. For digital payment solutions focussing on latest technology, security, customer experience and rich data, please visit us at EMLpayments.com